London’s hotel market has endured extraordinary challenges in recent years – from a pandemic to political uncertainty, rising operational costs and evolving guest expectations. Despite this, it remains one of the world’s most attractive hospitality markets, driven by strong revenue performance, renewed investor confidence and a willingness to adapt.

“London’s hotel sector continues to demonstrate remarkable resilience and adaptability,” says Will Kirkpatrick, head of hotels & extended stay at Newmark UK. “Despite shifts in corporate travel, the sector maintains one of the highest global occupancy rates, underscoring its strength as an investment class.”

Newmark’s latest ‘London Hotels’ report shows key performance metrics have not only recovered but, in many cases, exceeded pre-pandemic levels. The average daily rate (ADR) reached nearly £195 in 2024 – a 26% rise on 2019 figures. Revenue per available room (RevPAR), particularly in the luxury segment, has outpaced inflation by more than 8% since 2015. This robust performance has reignited investor activity, with 2024 seeing the highest volume of UK hotel transactions since 2018. Stabilised pricing and renewed capital flows are fuelling market optimism.

Cost pressures and smarter operations

Operational pressures, however, remain front of mind. To mitigate rising energy and staffing costs, many hoteliers are turning to technology and efficiencydriven systems. Kirkpatrick recommends limiting daily room cleaning for longer stays, incentivising guests to participate in sustainability initiatives, and investing in occupancy sensors, low-flow water fixtures and smart HVAC systems. “Hotels must align with increasingly stringent sustainability requirements while protecting their margins,” he notes.

Labour shortages and inflation are also driving digital adoption. Paperless check-in, AI-powered chatbots and even robotic housekeeping are being deployed to streamline operations. Yet Kirkpatrick cautions that in the luxury segment, automation must never come at the cost of the personal touch: “Technology should support human interaction, not replace it.”

On the regulatory side, the next business rates revaluation could pose significant financial risks. Kirkpatrick advises working with experienced advisers early to assess options and avoid unintended consequences: “A hotel may be under-assessed, and any contact with the Valuation Office without full understanding could result in higher liabilities.” Strategic responses include valuation appeals, claiming relief during refurbishments and filing for Material Change in Circumstance where conditions impact trading.

Rise of ‘bleisure’ and adaptive reuse

The profile of the modern traveller is changing. With remote and hybrid working on the rise, business and leisure travel are increasingly intertwined. This so-called “bleisure” trend is prompting hotels to rethink design and service offerings. Aparthotels and serviced apartments, such as Wilde by Staycity, are well suited to this shift – combining hotel-like services with home comforts, including kitchenettes and flexible living/ work spaces.

To capitalise on this demand, many London properties are expanding co-working lounges, wellness facilities and curated local experiences. These changes serve dual purposes – meeting the evolving needs of guests while unlocking new revenue opportunities.

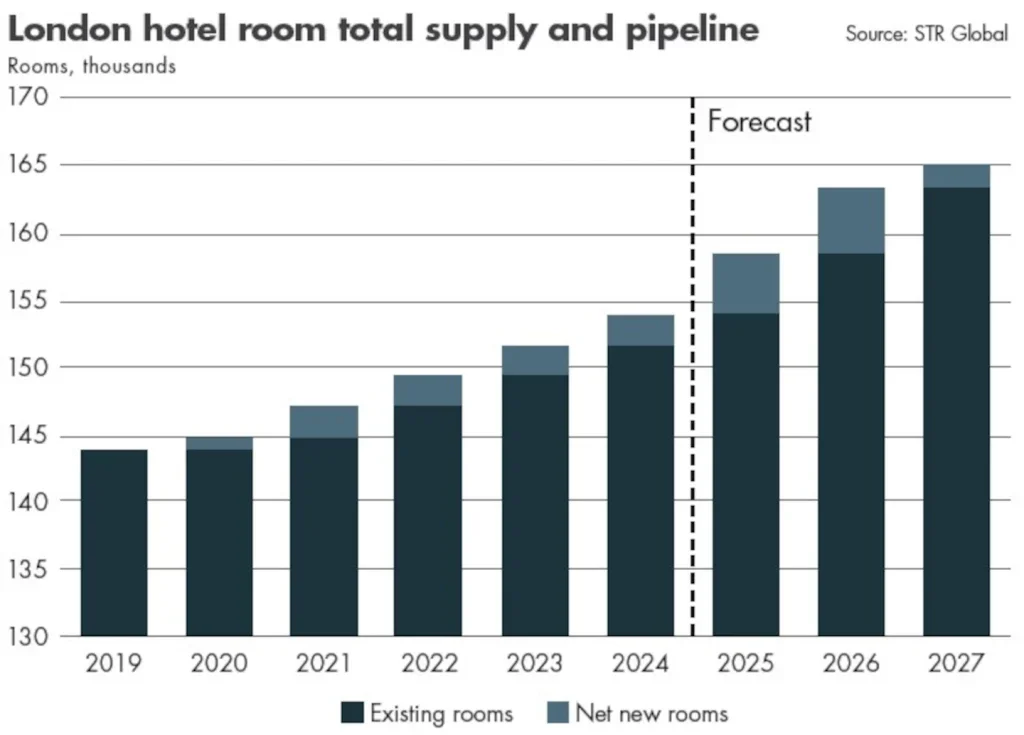

Looking ahead, adaptive reuse is expected to become a central feature of London’s hotel development pipeline. With high land costs and limited new development space, converting underused offices or heritage buildings into hotels offers a sustainable alternative. “Reuse can cut development costs, preserve architectural character and reduce embodied carbon,” says Kirkpatrick. The National Planning Policy Framework supports such projects, with studies estimating up to a 50% reduction in emissions compared with new builds. However, not every building is viable for conversion – structural limitations or unexpected infrastructure upgrades can drive up costs.

Leisure-led recovery

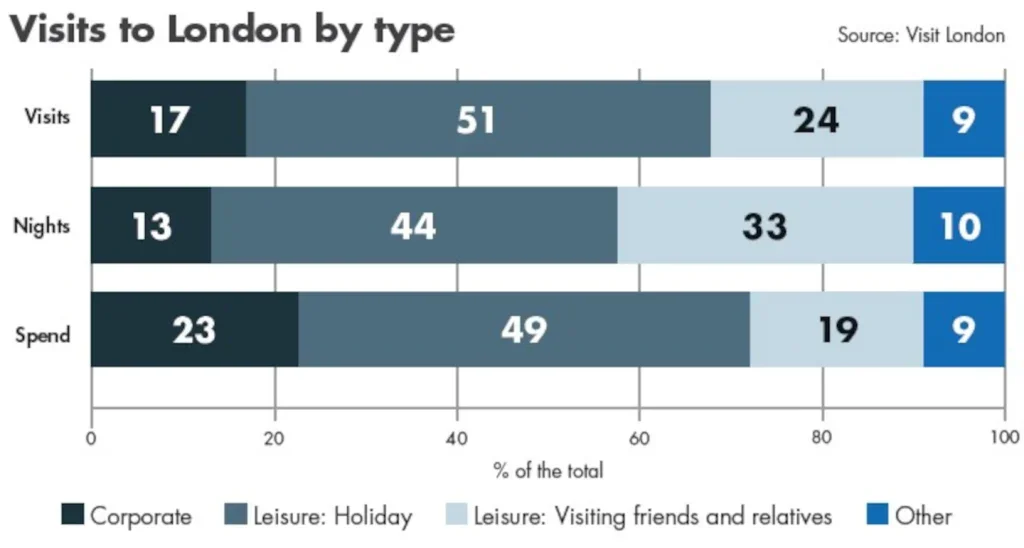

Leisure travel continues to drive London’s hotel performance, accounting for around 75% of stays. International visitors – especially from the US – are returning in force, with arrivals in 2024 up 75% on prepandemic levels and significantly higher average spend. Events like the Taylor Swift Eras Tour at Wembley have led to RevPAR spikes of 14%, underlining the need for operators to align pricing and availability with the city’s dynamic event calendar.

Although corporate travel volumes remain below pre-pandemic levels, average spend and length of stay have increased. “Agile working means business travellers are consolidating meetings into longer, more purposeful trips,” Kirkpatrick observes. These extended stays reduce housekeeping costs and boost profitability. Hotels near office hubs are responding with tailored meeting packages, flexible workspaces and analytics-led promotions aligned with corporate demand cycles.

London’s hotel sector now has two pillars to hold it up: resilience and reinvention. Strong top-line growth has reignited investor interest, but long-term success will depend on agile responses to rising costs, regulatory changes and shifting guest behaviours. By embracing sustainable development, digital innovation and adaptive reuse, the capital’s hotels are wellpositioned to thrive in a rapidly evolving global landscape.